2024 Annual Results

Final Dividend Up for Fifth Consecutive Year

| US$ Million* | 2024 | 2023 |

|---|---|---|

| Revenue | 777.98 | 863.49 |

| Gross Profit Margin | 47.2% | 44.6% |

| Profit for the Year | 92.78 | 149.95 |

| Net Profit Margin | 11.9% | 17.4% |

| Basic Earnings per Share | 0.086 | 0.138 |

| Proposed Final Dividend per Share | 0.032 | 0.029 |

| Payout Ratio | 73.2% | 40.9% |

*USD figures are converted from reported HKD numbers

*Numbers as of December 31, 2024

PAX Global Technology Limited (“PAX” or the “Group”, HKSE stock code: 00327.HK), one of the world’s leading providers of electronic payment terminal (“E-payment terminal”) solutions and related services, is pleased to announce its audited annual results for the year ended 31 December 2024.

In 2024, the global economy remained in a slow recovery phase. High interest rates and a strong U.S. dollar led to more cautious deployment of payment terminals among international clients. Guided by a long-term strategic vision, PAX proactively adapted to market conditions by advancing payment technology through its Android smart terminals and Software as a Service (SaaS) solution. While expanding its global footprint, PAX also implemented a U.S. dollar settlement strategy for overseas operations, effectively mitigating foreign exchange risk and enhancing the Group’s overall risk management. Additionally, PAX strengthened financial resilience through disciplined credit control and optimized shipping strategies.

During the year, the Group achieved revenue of US$777.98 million and a profit of US$92.78 million, resulting in a net profit margin of 11.9%. Net cash generated from operating activities reached US$149.64 million, underscoring the Group’s strong cash flow generation capabilities despite global market headwinds. The Board has recommended a final dividend of US$ 0.03 (HK$0.25) per ordinary share for the year ended 31 December 2024.

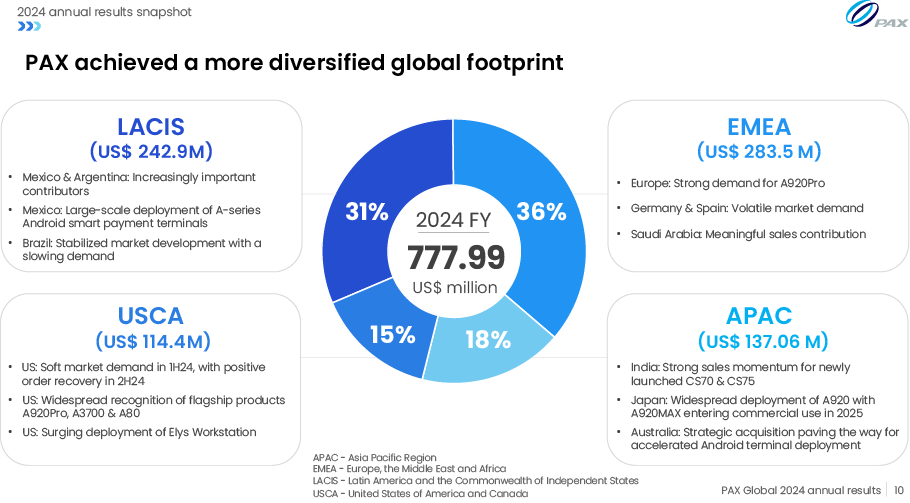

Global Regional Analysis

The United States of America and Canada (USCA)

In the first half of 2024, cautious investment strategies from retailers, ISOs, and financial institutions led to slower deployment of payment terminals and a temporary dip in market demand. However, as the market gradually rebounded in the year’s second half, orders surged, driving renewed sales growth across North America.

Leveraging a robust portfolio of Android smart payment terminals, the Group continued to strengthen strategic partnerships with banks while actively expanding direct-to-retail sales channels. These efforts have broadened the customer base to include sectors such as cinemas, telecom providers, convenience stores, and quick-service restaurant chains, delivering efficient payment solutions tailored to diverse business needs. Flagship products like the A920Pro, A3700, and A80 have gained widespread recognition in the market. Additionally, significant progress was made in securing product certifications with banks, laying a solid foundation for future deployments.

The Group also accelerated its strategic push into the Android-based EPOS market, supporting the digital transformation of the retail and hospitality sectors. The PAX Elys series gained strong traction among PSPs, with increasing adoption of the Elys Workstation fueling continued sales growth.

For more information, please refer to the full article, announcement and presentation.